By Gabriela Otto, President of HSMAI Brazil and Latam, directly from Indianapolis, US, at the HSMAI Commercial Strategy Week 2025

We are facing a time that demands that the hotel industry take a new look at customer behavior. Del Ross's presentation (Senior Advisor, McKinsey & Company), one of the most respected names in global business strategy, brought essential reflections for the current scenario and extremely applicable to the Latin American market.

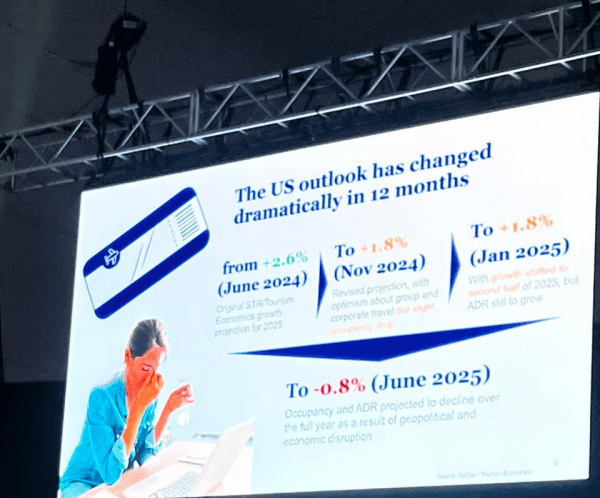

While in Latin America we discuss the challenge of corporate recovery and the balance between leisure and business, the North American market is already projecting a “fine-tuning” scenario in 2025: a drop of -0.8% in ADR and occupancy (STR Tourism Economics), after an expectation of +2.6% in the previous year.

1. US Economic Outlook (12 Turbulent Months)

In June/2024, the growth expectation was +2.6%.

In November, the forecast fell to +1.8%.

In January/2025 it remained at +1.8%, but was already signaling a slowdown.

Now, in June/2025, the projection is negative: -0.8% — official drop in occupancy and DM for the year.

The environment of high inflation, cooling corporate demand, and geopolitical tensions is no longer theoretical; it's reality for Americans. In Latin America, the message is clear: if the goals are "cloudy," prepare for cold reality checks.

What are the most strategic lessons learned at this time?

- Medium-sized companies, a market to conquer.

With over 4 million US businesses spending over $100,000 annually on hospitality, and with players With medium-sized companies growing (while large groups are more volatile and conservative), segmentation needs to be reviewed. In Latin America, there is a "blue ocean" of medium-sized companies poorly served by hotel chains. - RevPAR under pressure, sales cycle changing.

With leisure demand returning to normal levels and corporate demand resuming with lower average rates and shorter stays, RevPAR dynamics are changing. - AI as a strategic driver: accessible, scalable, and transformative.

While many still fear AI, the panel was clear: it is disruptive, cheap, trainable, and scalable.

The highlight of the panel is clear: Agentic AI (AI agent), an AI that goes beyond "Talk or Show." It decides, learns, and executes autonomously. Applications in the hospitality industry:

- Faster 80% content creation

- More agile 30% operational processes

- More automated digital customer service

- Faster 80% content creation

- This is the "new normal," and it's no use pretending it hasn't arrived. Revenue Managers and Marketing professionals need to map out what to automate today to free up their professionals' time for what generates real connection.

In Latin America, we're just scratching the surface of this potential. It's time to prepare not only the RM team, but also the Sales and Marketing teams for a new level of data and technology use. - Rethinking segmentation and sales methods.

Del Ross was direct: “The secret is to try new things”.

It is necessary:

- Rethinking the market and improving team skills

- Do not give up the corporate market to OTAs

- Do not use competitive sets obsolete ones that limit growth

- Be ready to sell in falling markets

- Rethinking the market and improving team skills

The winning strategy now is: analysis, segmentation and persistence

- Data Analysis (analysis) – data mining to identify customers prospects.

- Targeting (segmentation) – tailored “go-to-market” plans: in-person visits, presentations with local DNA.

- Persistence (persistence) – Cycle: discovery → proposal → delivery → feedback, with continuous momentum.

In conclusionThe consumer of 2025 is more complex, more demanding, and less predictable. Understanding their new decision drivers requires:

- Intelligent data reading

- Strategic use of AI

- Review of business models

- Full integration between RM, Sales and Marketing

Latin America, with its creative resilience, has a unique opportunity to lead this new phase, if it accelerates the mindset strategic and technological.